Mortgage Rates Climb to Highest Level Since February, Slowing Loan Applications

According to the Mortgage Bankers Association’s (MBA) latest weekly survey, mortgage rates surged to their highest levels in several months, aligning closely with daily rate data from Mortgage News Daily (MND). The upward trend in rates appears to have weighed heavily on both home purchase and refinance activity.

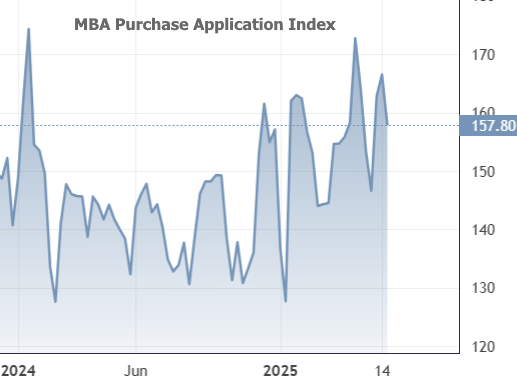

“Mortgage rates jumped to their highest level since February last week, with investors concerned about rising inflation and the impact of increasing deficits and debt,” said Mike Fratantoni, MBA’s Senior Vice President and Chief Economist. “Higher rates, including the 30-year fixed rising to 6.92 percent, led to a slowdown across the board. However, purchase applications are still 13 percent higher than they were at this time last year.”

Weekly Rate Summary from MBA Survey:

- 30-Year Fixed: 6.92% (+0.06) | Points: 0.69 (+0.01)

- Jumbo 30-Year Fixed: 6.94% (+0.09) | Points: 0.72 (+0.23)

- FHA Loans: 6.60% (+0.01) | Points: 0.96 (+0.07)

- 15-Year Fixed: 6.21% (+0.09) | Points: 0.72 (+0.13)

- 5/1 Adjustable-Rate Mortgage (ARM): 6.16% (+0.07) | Points: 0.36 (−0.38)

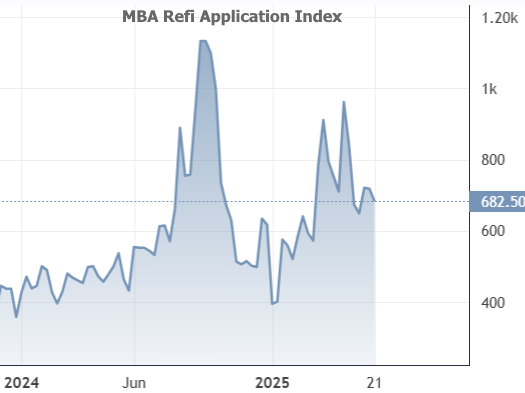

Daily data from MND indicates that rates could edge even higher in the coming week, which would likely present further challenges for the refinance market. While refinance applications tend to respond quickly to interest rate changes, home purchase activity is often more resilient in the short term.

Application Volume Breakdown:

- Refinance Share: 36.6% (up from 36.4%)

- ARM Share: 7.1% (down from 7.4%)

- FHA Share: 17.9% (up from 17.4%)

- VA Share: 12.6% (down from 13.4%)

- USDA Share: 0.5% (unchanged)

As mortgage rates continue to rise, borrowers may face increased pressure in both affordability and loan qualification, making rate trends a critical watchpoint for the housing market in the weeks ahead.

🔑 Take the Next Step Toward Financial Freedom

Whether you’re purchasing your next rental or refinancing a cash-flowing property, a DSCR loan can help you scale faster with less red tape.

👉 Apply now with Truss Financial Group — your trusted DSCR loan experts.

📝 Click here to get started today

No tax returns. No stress. Just real funding for real investors.